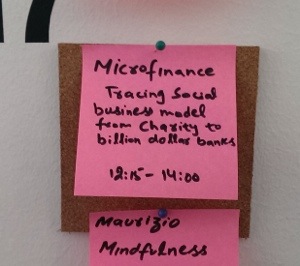

“Tracing social business models from charity to billion dollar banks” – This was the title of a lunch session at the Impactory in Luxembourg. I joined forces with the Executive Director of LMDF – The Luxemburg Microfinance and Development Fund, Kaspar Wansleben, to give participants a good introduction on microfinance and how its business models changed over time.

“Tracing social business models from charity to billion dollar banks” – This was the title of a lunch session at the Impactory in Luxembourg. I joined forces with the Executive Director of LMDF – The Luxemburg Microfinance and Development Fund, Kaspar Wansleben, to give participants a good introduction on microfinance and how its business models changed over time.

Participants were mainly interested in the following issues:

Negative incidents related to microfinance in Andrah Pradesh, India related to inadequat recovery measures by microfinance institutions (MFIs) resulting in a number of suicides.

These incidents were very punctual, and should not be generalized around the whole industry. At the same time, the incidents showed the great importance of social performance indicators which measure – among many ither things – how MFIs treat their clients and their staff.

Very high interest rates, reaching even up to 70% effective interest rate, in microfinance.

Microfinance has very high administration cost. Were a bank disburses a loan of USD 100,000 with one loan officer just amalyzing audited financial statements, the MFI has to disburse a 100 USD1.000 loans by visiting every client at home and on his business premises. At the same time also in microfinance you see interest rates coming diwn when competition increases with more and more providers.

Need for the microfinance client to have socially responsible project.

This depends very much on your own conviction. From my point of view, it is completely fair for a client to want to buy an oven for his or her bakery, or a fridge for her bar, or maybe a new bus for his transport business. If we see microfinance as part of the financial system, MFIs provide financial services to low-income clients, not just to those with a socially responsible loan purpose.