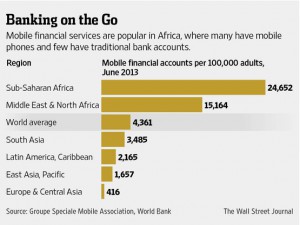

The Wall Street Journal article describes how mobile phone payments grow in Africa and how operators are rushing to get a piece of the often very lucrative pie. The GSMA reports 219 mobile money deployments worldwide of which 52% are in Africa. Up to now, most stories around mobile money circled around MPesa in Kenya. Their service is now available in seven African countries and it has 16.8 million active customers, of which the vast majority are in Africa. It handles more than $1 billion in transactions per month in Kenya alone and it charges about 1% of the total amount being sent.

The Wall Street Journal article describes how mobile phone payments grow in Africa and how operators are rushing to get a piece of the often very lucrative pie. The GSMA reports 219 mobile money deployments worldwide of which 52% are in Africa. Up to now, most stories around mobile money circled around MPesa in Kenya. Their service is now available in seven African countries and it has 16.8 million active customers, of which the vast majority are in Africa. It handles more than $1 billion in transactions per month in Kenya alone and it charges about 1% of the total amount being sent.

More and more companies seem to be entering partnerships to be better able to deal with regulation, scattered expertise, and different comparative advantages:

Western Union for example, announced to offer a new mobile money transfer service in the Ivory Coast. This new service will let people using MTN’s Mobile Money service receive a money transfer transaction via Western Union directly on their mobile phones.

Vodafone and MoneyGram joined forces to create a system to transfer funds directly from roughly 200 countries to M-Pesa’s customer base.

In Nigeria, MasterCard has developed a digital national ID card which can also receive payments from abroad electronically. The ID card, officially launched late last month by Nigeria’s President Goodluck Jonathan, doubles as a payment card that can be pre-loaded with cash.

However, customer adoption and regulation represent still challenges in many African markets. Let´s see how it continues…